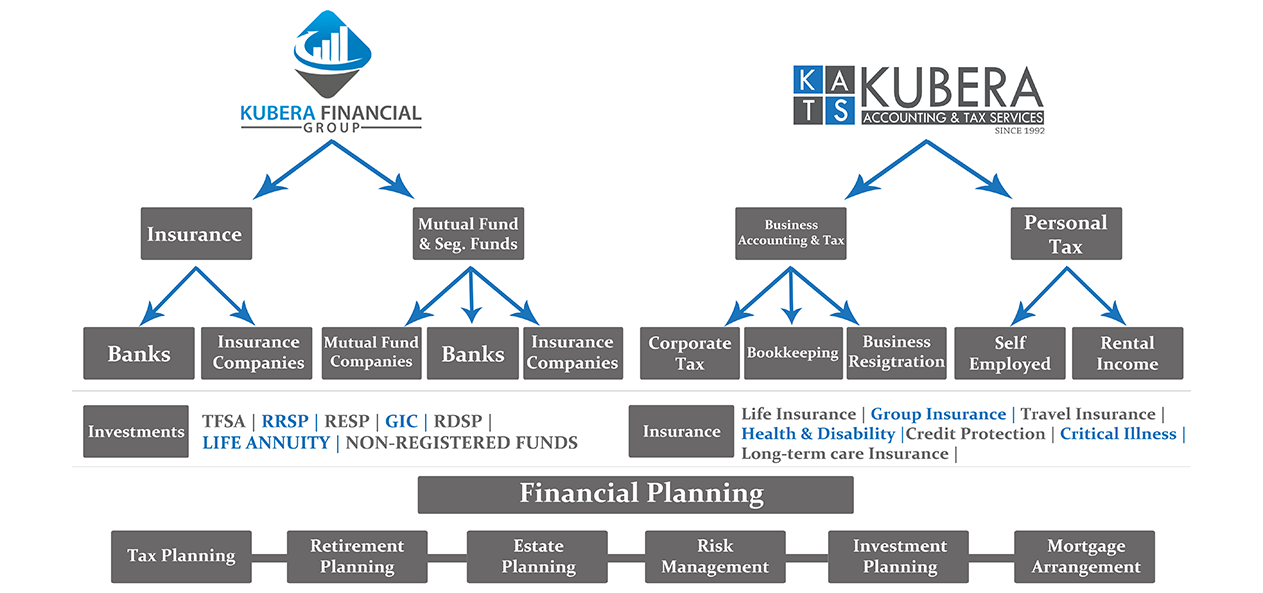

A Toronto Based, professional accounting and tax consulting firm, providing a wide range of accounting and business consulting services to small and medium sized businesses for more than 25 years.

In addition to accounting and tax expertise, the company support clients to building successful businesses while helping business owners and managers to provide for their individual financial future.

Whatever the goals, the team of professionals at Kubera Accounting & Tax Services (KATS) works diligently with clients in a confident, customer-focused and results-oriented manner to plan, outline, and implement actions to achieve business success

Establish and enjoy the benifits of a fully functioning Accounting department using our specialized service. We can develop and implement accounting policies and procedures, train staff and provide support to ensure departmental objectives are acheived.

Kubera Accounting & Tax Services help business leaders make business decisions through account preparation and management of A/P, A/R, G/L maintenance, payroll balance sheet, income statement and cash flow. We can present you with a clear picture of the bottom line with details of assets and liabilities; facilitating corrective actions and growth opportunities.

From consultation and tax planning wer can prepare the complete income tax returns for your business encompassing areas such as Payroll, GST/HST, Excise Tax, Changes in Business Status, Automobile, Fixed Asset Depreciation, Research, Foreign Investment Reporting and many other areas that may be applicable to your business. Moreover, Kubera Accounting & Tax Services can assist in CRA audits and the preparation of carious documents in case of appeal. Expertise in the preparation of Canadian tax returns including all provinces

Ensure all necessary deductions and calculations as per Canada Customs and Revenue Agency (CCRA) requirements are made, obtain timely and accurate weekly/ bi-weekly/ semimonthly/ monthly basis paycheques. T4s and ROE services as well as record maintenance and pertinent advice by using our payroll service

Get the factual picture of your business performance complete with documents and information required by CCRA. Kubera Accounting & Tax Services can also incorporate pertinent accounts and information for the preparation of business returns.

Facilitate more cash inflow than outflow, identify cash flow gaps before they occur, know what is required to sustain your business, and obtain signs of possible expansion. Kubera Accounting & Tax Services can provide you with crystal clear projections, breakeven levels, profit goals, market position, and help you predict the future of your company.

Train and coach commissioned staff on how to provide tax advice to their clients and the relevant information/documentation to obtain to facilitate closure of deals in a timely manner

Curtail overpayment or duplicate payment to vendors as well as sales tax and freight. Kubera Accounting & Tax Services provides cost reduction/recovery and account analysis service aimed at identifying such occurrences and providing you with recommendations for improvement.

Thorough analysis of inventories and costing of inventories for financing or business sale purpose. Kubera Accounting & Tax Services also assist new and upcoming businesses with business plan, business registration and incorporation

Kubera Accounting & Tax Services can design, upgrade and/or convert your existing accounting system to one that would generate the reporting systems and controls.

Identify overpayment or underpayment, optimize the use of input tax credits and maintain an excellent reputation for tax compliance with Canada Revenue Agency (CRA). We can provide your business with systematic and detailed working of GST/PST, review of past remittances, adivce or proper record keeping, and tax consultation.

Kubera Accounting & Tax Services can help with personal tax and E-file service for filing returns covering all possible legitimate entitlements. We also provide our clients with financial planning, tax avoidance and insurance strategies to help them build and protect their financial future.